USDA funds bring certain commission assistance applications, plus gives and money which will help to the can cost you related which have purchasing a home. Such software are made to make homeownership a lot more available, specifically for lowest in order to moderate-earnings somebody. Payment direction is lessen the month-to-month mortgage repayments to own a specific months and, in some cases, about lifetime of the loan. Eligibility of these software need candidates to meet up with particular earnings standards and you will demonstrated the experience and you will desire to settle your debt.

Geographical Attention

The program tailors for the country’s novel landscape, which includes a variety of towns and cities such as for instance The brand new Orleans and you can Baton Rouge, and various rural communities where economic solutions are simple.

Wisdom Rural Elements

USDA Rural Advancement funds can handle rural areas; nations normally discover external busy metropolitan facilities. Such elements usually do not have the financial powers found in metropolitan areas. To own USDA loan qualifications, outlying portion is actually laid out of the certain society thresholds and you may geographical requirements that prohibit urban centers instance The newest Orleans and Rod Rouge.

Louisiana-Particular Factors

During the Louisiana, USDA Outlying Invention programs has actually a critical impact considering the nation’s varied topology. Section like the surroundings away from Shreveport can get be eligible for such funds. The newest comparison brings together available social research and aims at bolstering the brand new socio-financial fabric contained in this qualified groups.

Residential district against Outlying Traditions

Suburban components such as those to your outskirts from Baton Rouge otherwise The fresh new Orleans vary from USDA Rural Development’s appointed rural parts. Suburban zones might have denser populations and higher degrees of infrastructure and you may attributes than simply USDA-designated rural elements.

System and you will Invention: Residential district places tend to have well-built characteristics as compared to particular rural elements, and this USDA funds should boost.

Homeownership Trends: Residential district homeownership might possibly be passionate of the lifestyle tastes, if you find yourself rural USDA fund work on assisting entry to casing in which resources are scarce.

Most Info

For those trying to then clarity towards the USDA money in Louisiana, another info promote advice and up-to-go out recommendations. These types of tips target popular inquiries and offer some tips on navigating brand new pressures introduced ahead by the COVID-19.

Faq’s on USDA Finance

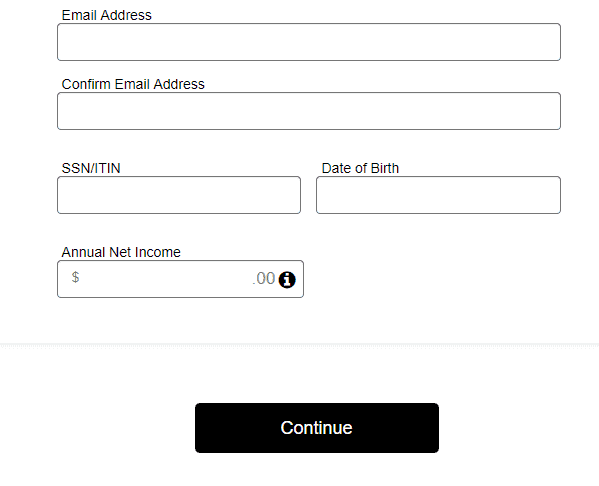

Faq’s into the USDA finance include various topics in addition to qualification, financing limitations, and you will income requirements. Candidates commonly inquire about the brand new information on the newest Point 502 Lead Loan Program, and therefore aids reduced- and also-low-earnings candidates. USDA loan limits when you look at the Louisiana commonly pre-put but they are determined by a mix of earnings limits and you may debt-to-income ratios of your individuals. To deal with this type of questions, tips like the USDA’s authoritative webpages and you will regional USDA Outlying Creativity workplaces bring answers and custom direction.

Bodies Support while in the COVID-19

The fresh USDA loan system has brought methods to help consumers affected by COVID-19 pandemic. Tips is offering payment moratoriums and extra flexibilities for financing money to help mitigate financial hardships. Detailed information within these alterations exists into USDA’s and almost every other federal agencies’ websites, that have areas seriously interested in COVID-19 info. These types of information book individuals and you will communities for you to power government service in order to maintain homes balances throughout these tricky moments.

Analysis along with other Loan Solutions

When investigating financial solutions during the Louisiana, USDA fund get noticed because of their no downpayment criteria, which contrasts with other financing types. Particularly, USDA loans are usually than the FHA, Virtual assistant, and old-fashioned financing choice, for every single which have collection of eligibility criteria and gurus.

USDA compared to FHA Fund

USDA loans is targeted with the possible homeowners within the rural parts and you may give you the advantage of zero deposit. On the other hand, FHA financing want the absolute minimum down-payment, typically 3.5%. However, FHA finance are more flexible concerning your location of the property as well as have shorter stringent money restrictions.