Perhaps the domestic you’re eyeing is a vast mansion otherwise a beneficial simple farmhouse, GVC Home loan helps you select the primary loan for your brand new home in the Indianapolis. Having most mortgages and you will software available-FHA, USDA fund, and much more-we will pair your that have the one that suits the money you owe and you may specifications. Implement today in order to plan a meeting with our experienced gurus, otherwise call us at the (317) 564-4906 (Indianapolis) otherwise (317) 754-4008 (Plainfield) which have any queries in the acquiring a home loan.

Writeup on Mortgage Systems

We are able to help you get a variety of domestic and location-particular software that save money. Comprehend below to see which choice fits finest:

- FHA 203(b): For those who qualify for this program, the fresh new FHA ensures the loan. This allows you to pay nothing-to-no cash on advance payment during the Indianapolis. What’s more, it lets their financial to provide low interest.

- Conventional: Because financing actually insured by FHA or protected by the the newest Virtual assistant, you prefer a good credit score so you can be considered. So it mortgage enables much more versatility and liberty than many other software manage.

- FHA/HUD 100: If you purchase property that was foreclosed from the Company from Construction & Urban Invention, then you can be considered to invest $100 with the advance payment.

- USDA/RD: This choice also offers larger deals for all those finding to get a good house from inside the outlying groups.

- FHA 203(k): Good for fixer-uppers. In the event that qualified for this method, you imagine how much cash fixes and you can renovations carry out costs, immediately after which move those individuals upcoming can cost you in the domestic purchase price. This provides you you to definitely quick and easy mortgage.

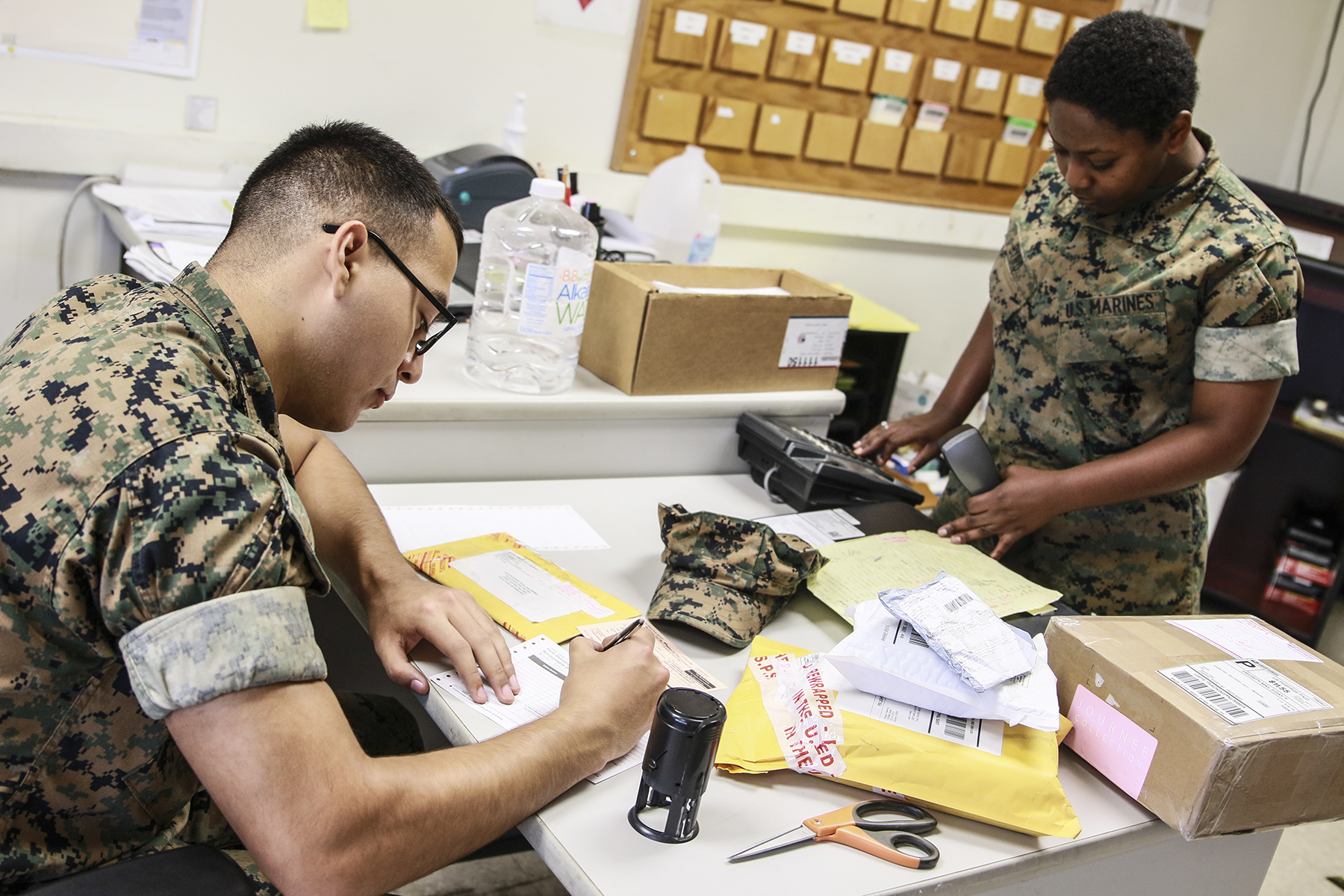

- VA: The fresh new Va pledges a great lender’s mortgage to have experts and https://paydayloanalabama.com/mosses/ you may service participants, enabling these to buy, redesign, otherwise generate a house. Because a many thanks for your provider, we do not charge underwriting charges.

- Doctor: Designed for recently graduated medical children, doctor funds, known as doctor mortgages, require little to no money down and no private home loan insurance policies (PMI) to help you secure a great jumbo home loan.

- Jumbo: Jumbo mortgages is mortgage brokers one exceed conforming mortgage constraints. A jumbo loan is a sure way to get a top-listed otherwise deluxe domestic. When you have a lowered financial obligation-to-earnings proportion and a top credit score, a jumbo loan can be effectively for you.

FHA 203(b)

This is why if you don’t maintain your payments and you will default, the new FHA concludes making the remainder of your repayments right after which enjoys your house. So it insurance helps make the financial less risky on financial, very they are normally prepared to offer ideal words.

The fresh new FHA 203(b) was a popular system since it has many positives. Occasionally, the customer just should shell out 3.5% of cost to the down-payment. In place of this help, of numerous property owners are required to spend ten20% of your purchase price on the down-payment. New FHA 203(b) eliminates have to have a large amount of money protected before buying property. In addition, the customer normally discuss rates of interest with the FHA.

Antique Mortgage

Rather than being covered by FHA or protected by the Va, a conventional loan uses the house and you can family since the guarantee facing defaulting. You be considered considering your credit score. When you yourself have bad credit, you may not be considered. Your credit score is indeed important because the us government actually providing insurance. The lender needs to make sure you are reliable sufficient to repay.

When you are more difficult to obtain, traditional alternatives offer a great deal more versatility than just authorities-insured funds. FHA software normally have numerous regulations and rules that must definitely be accompanied you to conventional loans dont. At exactly the same time, extremely loan providers do not require financial insurance policies. You can expect repaired or changeable rates. However, anticipate to afford the complete deposit price for your family.