Origination is the foremost phase of credit services that each private have to read to obtain financing, eg an unsecured loan, team financing, mortgage, car finance, etc. Origination is a multiple-action processes, between application and you will underwriting so you’re able to disbursal off finance.

All the financing sorts of are certain to get various other approval procedure and you may criteria that is tips guide and you may automatic. The borrowed funds origination process is going to be paper-depending or digital. The fresh electronic process boasts the whole gamut of your mortgage origination techniques with just minimal paperwork.

step one. Pre-degree techniques

Pre-qualification is the first rung on the ladder about mortgage origination procedure. Mortgage applicant supplies pointers into the financial or even the alternative party particularly term/ address information, most recent work info, money, percentage record, tax returns and you can expenses, and you can amount borrowed needed. In line with the given suggestions and available mortgage choices, the lender pre-approves the borrowed funds and you can helps make a deal, allowing the brand new debtor to carry on.

For example, Rohit Bansal really wants to get a home loan to acquire an effective family really worth Rs. 31 lakh. He applies to your financing on the web to know the quantity and you will interest on that he’s eligible for. The lending company needs basic details about his money and you will current expense. Based on the facts, the financial institution claims Rohit is eligible for a loan from Rs. 25 lakh. The guy need submit records and you can undergo a great deal more recognition techniques.

dos. Documentation

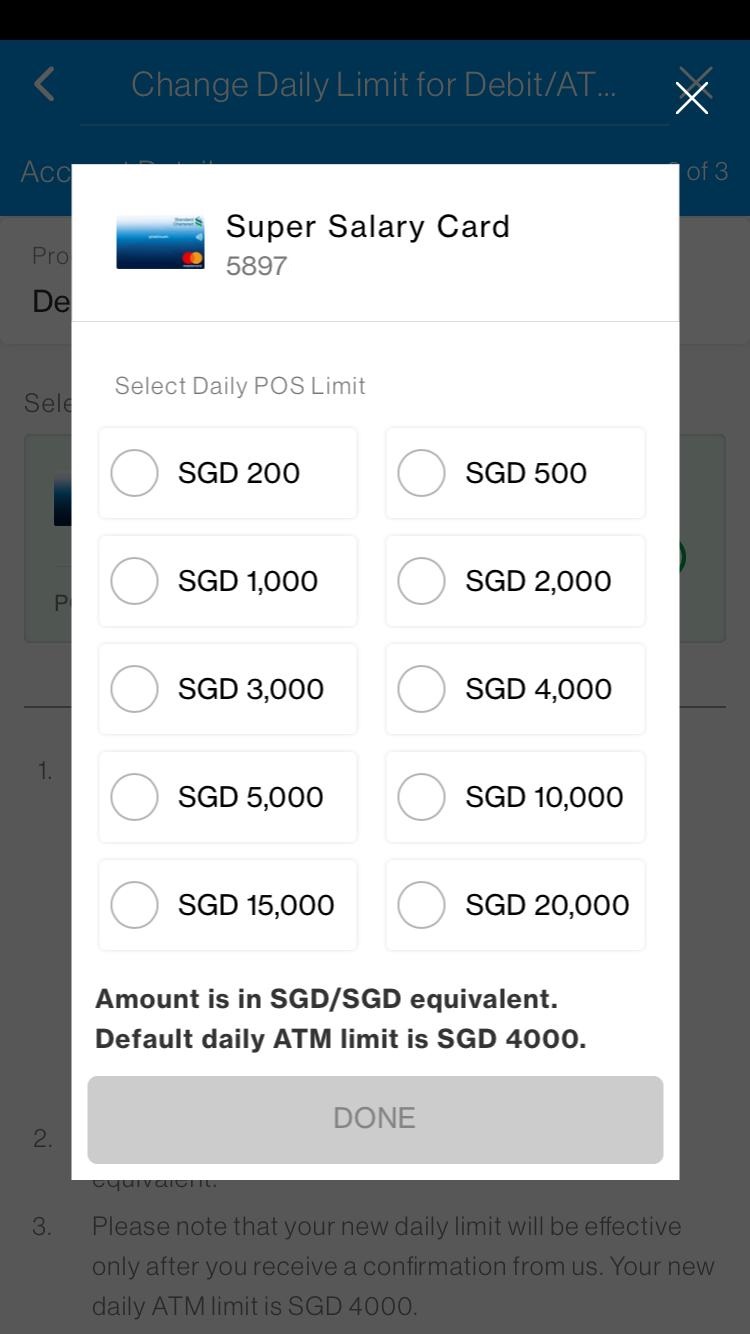

Another stage of your own financing origination procedure is actually papers. This new debtor needs to complete the app processes of the distribution related documents to help you substantiate earnings, a job, economic situation and other background. New borrower can also be complete the new documents on the web through the lender’s website or mobile application, or simply check out the nearest department of your lender to submit hard copies.

step three. App processing

After acquiring the application, the credit department feedback they to possess reliability and you may completeness. Or no error was noticed on app or perhaps the applicant has not yet provided every information necessary, the financing analyst comes into contact into mortgage candidate so you’re able to procure the required lost guidance.

Lenders fundamentally have fun with Loan Origination Software (LOS) to evaluate the borrowed funds application. According to the formulas employed by a lender, a sophisticated LOS can immediately flag data that have lost areas and you can display it with the borrowers to do it.

cuatro. Underwriting processes

The new underwriting processes takes on a definitive character about acceptance out-of a loan application. The lender evaluates the mortgage app against many standards such as credit score, exposure get, financial obligation to money ratio, and you may payment potential. Particular loan providers also check the electronic footprints of your financing debtor. The brand new underwriting process is usually fully automated by using a corporate regulations system and you will API integrations on financing origination program. During the a corporate laws engine, lenders include underwriting direction certain so you can affairs.

5. Credit decision

Based on the outcome of the newest underwriting processes, the borrowed funds application is acknowledged, refused or repaid into the originator so you’re able to procure facts. A rejection may be reconsidered if there are particular alterations in details, for example less amount borrowed, enhanced financing period or changed interest levels to lessen installment payments.

This task can automated with a laws system to own a level of predictability. Actually lesser changes in the fresh new parameters, particularly interest rates, tenure and you will amount borrowed, would be followed for the system versus coding.

6. Top quality have a look at

Individual financing try securely managed for the India. Laws need lenders to keep standards in accordance with financing adequacy, dollars set-aside proportion, borrowing from the bank roof, KYC norms, an such like. And that, the high quality handle action is a must in order to credit institutions. The loan software is delivered to the quality handle queue to own auditing to determine full conformity with external and internal guidelines and you will statutes. This is certainly basically the past writeup on the program ahead of disbursal. Quality control facilitate the lenders to get rid of people lawsuit and you can disciplinary action in case there are a dispute.

seven. Financing Financing

Very user finance is actually paid as the mortgage data was finalized. Company mortgage, credit line and you may next mortgages usually takes additional time for legal and you will conformity factors. Financial items a check or demand draft, that you’ll found regarding the bank department or is couriered toward target. Oftentimes, the borrowed funds number might be credited into the family savings as a result of NEFT.

Automation of mortgage origination techniques

As stated earlier, user lending was tightly managed inside the Asia. Legislative reforms allow it to be all the more hard for loan providers to make sustainable funds avenues. A totally incorporated, data-driven loan origination system (LOS) might help loan providers spend less when you are cutting years times.

In a survey conducted by Moody’s Analytics, 56% of bankers responded that their biggest challenge in initiating the loan process was manual collection of data and subsequent back and forth with the client.

Optimize abilities with automation

Tips guide loan origination processes is actually time-ingesting each action requires peoples intervention to be certain full compliance which have rules. Guidelines and report-based underwriting means shall be inconsistent and you may run out of auditability and you can reliability. People prefer timely, seamless and you may problems-100 % free entry to financing activities. From the applying a corporate regulations system, lenders will need to spend less big date to the coverage-dependent outlines mortgage origination techniques, grows yields and you may reduces operational will cost you.

Customer-up against electronic websites and you will application system interfaces americash loans Heritage Village (APIs) encourages electronic onboarding from established and you will prospective customer study to the fresh lender’s mortgage origination system. Following, lender-laid out business laws and regulations is automate the following stages in the process, segregating the mortgage applications which can be able to own choice and you may applications with missing advice.

Automation may enjoy an important character in assisting borrowing from the bank experts. Cutting-edge mortgage origination choices succeed loan providers to engage through its industrial user’s program thru an internet site, that have suitable permission. Including, lenders normally chart the relevant economic data to the a map out-of profile about equilibrium layer, income/ debts, cashflow and you will tax forms.

Completion

Markets worldwide have raised overall performance and you will yields with automation. Monetary community desperately need innovation and you will autonomy to face current market demands. not, the organization from originating small company and you will industrial loans remains work on retrospectively in the sense it was years ago.

Old-fashioned lenders try up against stiff race out-of technical-let competitors. Conventional banking institutions must embrace automation steps inside their mortgage origination ways to satisfy switching consumer needs or any other demands. Loan providers one admit a need to be more efficient, active, and you may attentive to their clients along with have to pertain condition-of-the-ways technical possibilities. Automatic statutes motor allows lenders to meet up with a whole lot more strict regulating examination requirements.

Automation of your own financing origination procedure from start to finish even offers the many benefits of reliability, near real-big date investigation, enhanced overall performance, and reduced decisioning times. When you’re automating the mortgage underwriting techniques can establish specific pressures, this is build the brand picture because the a keen inong co-workers.