Enness specilaises for the brokering higher-well worth bridging funds inside the Dubai, the UAE and you may over the MEA area. But not much we wish to borrow and you can any sort of your own timeframe, Enness should be able to get you a competitive bridging mortgage that meets any needs.

Connecting Money Uses

Enness can also be plan bridging loans to have property inside Dubai or otherwise – against money spent you own in the united kingdom, European countries or in other countries in the MEA area, eg.

Bridging money makes you launch equity fastened on your possessions by using it because the collateral towards financing. A bridging mortgage are often used to get another possessions ahead of their old house is ended up selling, to get a property within auction, to invest in a property rather than going right on through a long financial software processes, to develop a home just before offering it, or to resolve difficulty, if you planned to buy an unmortgageable assets such as.

Bridging Fund: Enness’ Give

- Found abridging loan provide within 24 hours

- Have fun with any type of property as cover

- Zero lowest or limitation loan amount

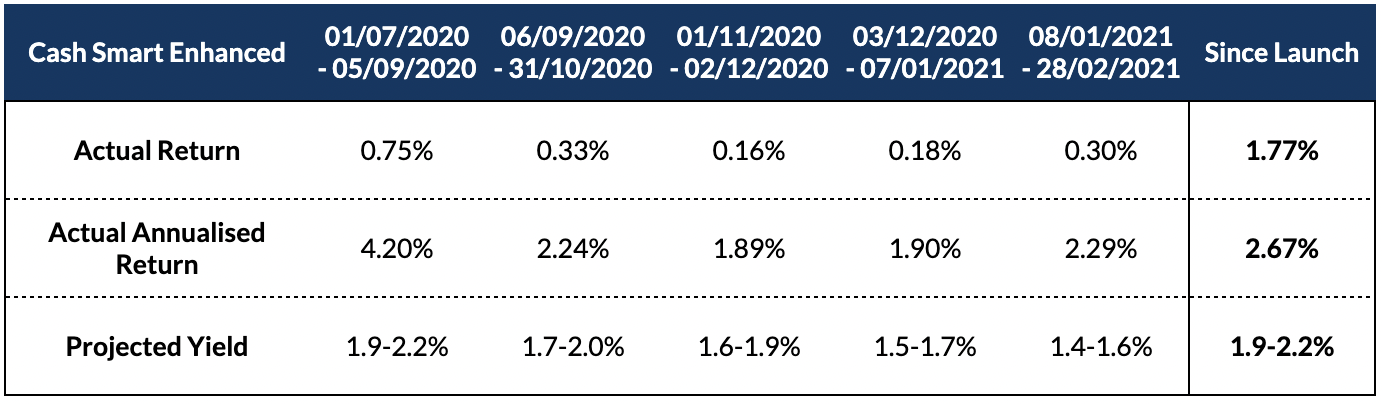

- Benefit from aggressive interest levels (doing 2.7% – 25% annually)

- Zero minimum label

- Explore bridging finance to own Dubai otherwise globally a property

- Availability controlled and you will unregulated connecting loan companies

Is actually Link Financing Effectively for you?

Bridging funds is a type of small-term borrowing. Such fund generally speaking work with from a few weeks to help you up to three years. He could be recognized for getting brief to set up, having funds offered to individuals in just days or weeks a lot faster than a mortgage or other sort of credit.

Connecting funds is oftentimes used by high-net-really worth people that you prefer entry to high investment easily. Consequently, these types of finance is renowned for getting anything away from good disease solver and you will an opportunity writer. Bridging financing might be used if the most other loan providers has actually turned into your off otherwise can not provide for you. The underwriting techniques for it kind of credit now is easier than to many other sorts of lending (and additionally mortgages), that’s what makes they faster to prepare.

You can find disadvantages and you may advantages to bridging finance, just as you can find to your different kind out-of financing, and it’s vital you are aware this type of before continuing with this particular sorts of finance. Enness’ Dubai-mainly based connecting money brokers are working along with you to answer their concerns, define bridging financing for the more detail, and find out if it is a great fit for you. Enness enjoys a global impact and access to most of the loan providers regarding connecting fund area, so that they can send get across-border connecting deals quickly and efficiently.

Bridging Mortgage Rates of interest

You are going to usually pay the rate of interest since the a share away from the mortgage number. Typically, which price is determined each month. 0.45%, 1%, or dos% monthly, such as for example.

Hired Appeal

Attract payments try subtracted from your own terrible loan amount and generally are accustomed security the attention will cost you while they accrue this means, you are pre-paying the appeal on financing.

Rolling Right up Focus

In lieu of paying rates of interest monthly, interest is added to the new the capital. This is usually determined month-to-month. Might afford the notice right back plus the an excellent funding from inside the a lump sum in the label.

Maintained Attention

In cases like this, you happen to be necessary to pay the focus pricing each month, just like you perform which have home financing.

While you are the best way to pay interest can appear apparently irrelevant measures up to many other areas of the deal, they’re able to provides a serious effect on the general number your spend and you will what you can acquire. Notice repayments might impact your hard earned money circulate, therefore choosing hence choice is effectively for you addressing lenders one to allows you to shell out need for the way in which was extremely good-for your is actually criticial. Enness’ connecting financing representative will go over all of one’s selection which help that determine how much each of them will surely cost and just how useful http://www.paydayloanflorida.net/century/ its in your situation. The agent will negotiate that have loan providers to deliver your chosen alternatives.