It certainly is vital that you find the best rates easy for a beneficial financial if you are looking at to invest in a property or browsing re-finance. That have MyRatePlan’s unique system, assisting you to get some of the finest mortgage brokers is pretty easy. MyRatePlan gives you the various tools and you will data you should make the best possibilities about mortgage loans, each and every go out. Immediately after it is possible to evaluate prices for different mortgage for the Albany, Ny hand and hand, you will be a great deal more sure of perhaps not overpaying on the much time follow you order you to definitely brand new home.

The way to get an educated Home loan Cost inside Albany, New york

We thinking of buying property from inside the Albany, New york will need that loan to buy the fresh household. To get a house inside cash, or expenses upfront, was an emotional suggestion for many of us, also the spot where the worth of the home is just as reduced due to the fact $50,000. One as the circumstances, individuals need to find an appropriate home loan which is better within their economic potential. One needs in order to safe financing with the low attention rates possible. Immediately after determining our home one to would like to pick, realtors typically direct consumers so you can lenders which have which they enjoys involved prior to. Customers should take the recommendation which have a-pinch away from sodium. Consider the broker might not have the best off appeal on cardiovascular system. The new broker may be simply trying to intimate the deal as soon that one can. It needs to be clear by now one to closing a mortgage contract isn’t as as simple it may sound specifically for first time consumers. At this stage, it’s best become sluggish but yes. This way, you need to use discover the best deal. It does not matter if you to desires to romantic the organization having a neighborhood financial or a big label business. The main thing would be to look home loan pricing online. Part of the object out-of MyRatePlan’s financial rate equipment is to try to assist your secure the cheapest mortgage rates in Albany, Nyc. The better your credit score, the better your own interest rate was. Credit scores are important because they yourself change the financial attention pricing that one can submit an application for.

The sorts of Lenders Available in Albany, Ny

Just like the discover an extensive selection of other consumers available, it makes sense that we now have including lots of different financing points in the business, plus repaired-rate mortgages and you may adjustable home loans. Those individuals are a couple of of the very most preferred version of mortgages, and each often suit different varieties of people.

In the event the customer becomes a fixed-rates mortgage in Albany, New york, their attention speed remains an equivalent about entire financing name, if or not you to definitely can last for ten, 20 or three decades. Towards the rate of interest existence an identical, the latest monthly payment matter as well as stays the same. A predetermined-rate home loan is a safe option, given that visitors never ever have one unexpected situations with how much cash their house payment is actually.

As his or her title implies, adjustable-price mortgages (ARMs) when you look at the Albany, New york do not have one lay interest. Alternatively, the pace can move up otherwise off. The most famous version of Arm are a mixture of an Arm and a predetermined-rate mortgage, often called a crossbreed Case. Having a first months, the mortgage features a predetermined interest. Next, the latest mortgage’s interest changes into the a fixed agenda. For example, a buyer could get a great six/dos Case. The newest half a dozen ensures that the borrowed funds have a fixed rate getting the initial half a dozen years. Both means that after that first several months, the rate adjusts all the 24 months. The situation having Arms is that the borrower’s payment you certainly will increase.

FHA Mortgages inside Albany, New york

Choosing ranging from fixed-rate mortgage loans and you can Possession is not the sole option a possible debtor have to build. Nevertheless they need envision whether or not they need to stick to antique https://elitecashadvance.com/personal-loans-ma/ mortgages otherwise rating a national-insured home loan. With old-fashioned mortgages, new price is amongst the lender and borrower. If the borrower defaults, the lender you can expect to lose cash. With regulators-insured mortgage loans, the government was support the mortgage and you can assisting to cover brand new financial if the a default occurs. Such mortgage has USDA money, Virtual assistant finance and you may FHA money.

Government Property Administration (FHA) mortgage loans enjoys home loan insurance policies available with the FHA, that’s in itself managed by government’s Department away from Houses and you may Urban Development (HUD). That have FHA finance in Albany, Nyc, it’s not simply very first-date customers which can be considered but almost any visitors. Consumers take advantage of FHA funds as off payments is just 3.5 % of your own residence’s rates, but in addition, nevertheless they need to pay the loan insurance policies each month, that produces their house payment more high priced.

Refinancing home financing within the Albany, Ny

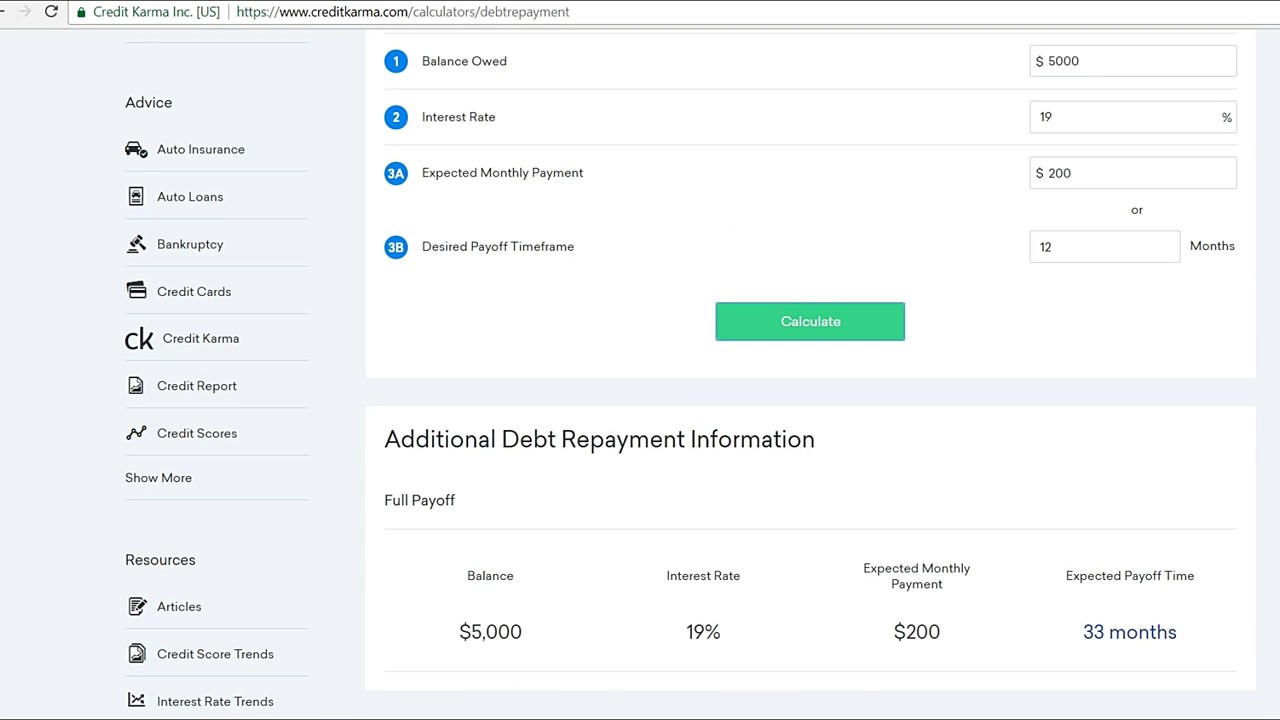

Whilst label was officially refinancing, just how this action work is the debtor can be applied to own an excellent brand-this new financial, which they used to afford the prior mortgage. The point of refinancing is the fact that the latest financial has actually a good most readily useful rate of interest than the dated you to, and therefore means that brand new borrower preserves currency by paying shorter desire into the remainder of the loan. The borrower is always to mention any extra will cost you that come with the fresh new the fresh new home loan, because there might be charge and you may closing costs inside. It is necessary that they do the math to ensure that they’re in fact saving cash when those costs was taken into account. not, if the debtor are switching of a supply to help you a fixed-speed home loan, which is always a good disperse since they’re perhaps not in the compassion regarding what will happen having rates, and therefore usually improve, maybe not fall off. Whenever mortgage refinancing, it’s important toward borrower to get their credit rating more than 700 and reduce the obligations-to-income ratio to appear as reduced exposure that one can to potential lenders and secure the low it is possible to interest rate. Luckily one to even a borrower just who doesn’t see every high requirements you certainly will still find a home loan during the Albany, New york that have a low interest rate.