Large down money normally trigger all the way down rates, and quicker (otherwise zero) off repayments can cause highest rates. Business conditions posit you to good 20% downpayment is member of a borrower’s ability to side adequate currency that he or she will additionally likely be capable satisfy its monthly home loan obligations as well.

This is why borrowers need to invest as often away from a beneficial deposit because they can as it then leads to an effective down home loan price. While doing so, buyers who can install merely 5 otherwise 10% get receive highest interest levels because they have less investment from the as soon as, that also might keep genuine afterwards.

Version of rate of interest

Rate conditions can be fixed or adjustable. A predetermined-rate of interest form a borrower will pay a comparable part of attract each month, and this can be better to consumers who don’t enjoy its revenue ascending far later, otherwise that are just much warmer securing within the a-flat price capable policy for.

A varying-rates financial (ARM) work the exact opposite means. The pace remains repaired more than a restricted preset several months, often five, 7, otherwise 10 years. After that, the interest rate goes up otherwise off yearly dependent on brand new lender’s words and you can a host of macroeconomic casing things.

Possession can be decreased at the beginning of a loan, although eventually, they frequently become more high priced every month. These types of financing was, ergo, ideal for consumers just who plan on swinging from inside the fixed-rates period.

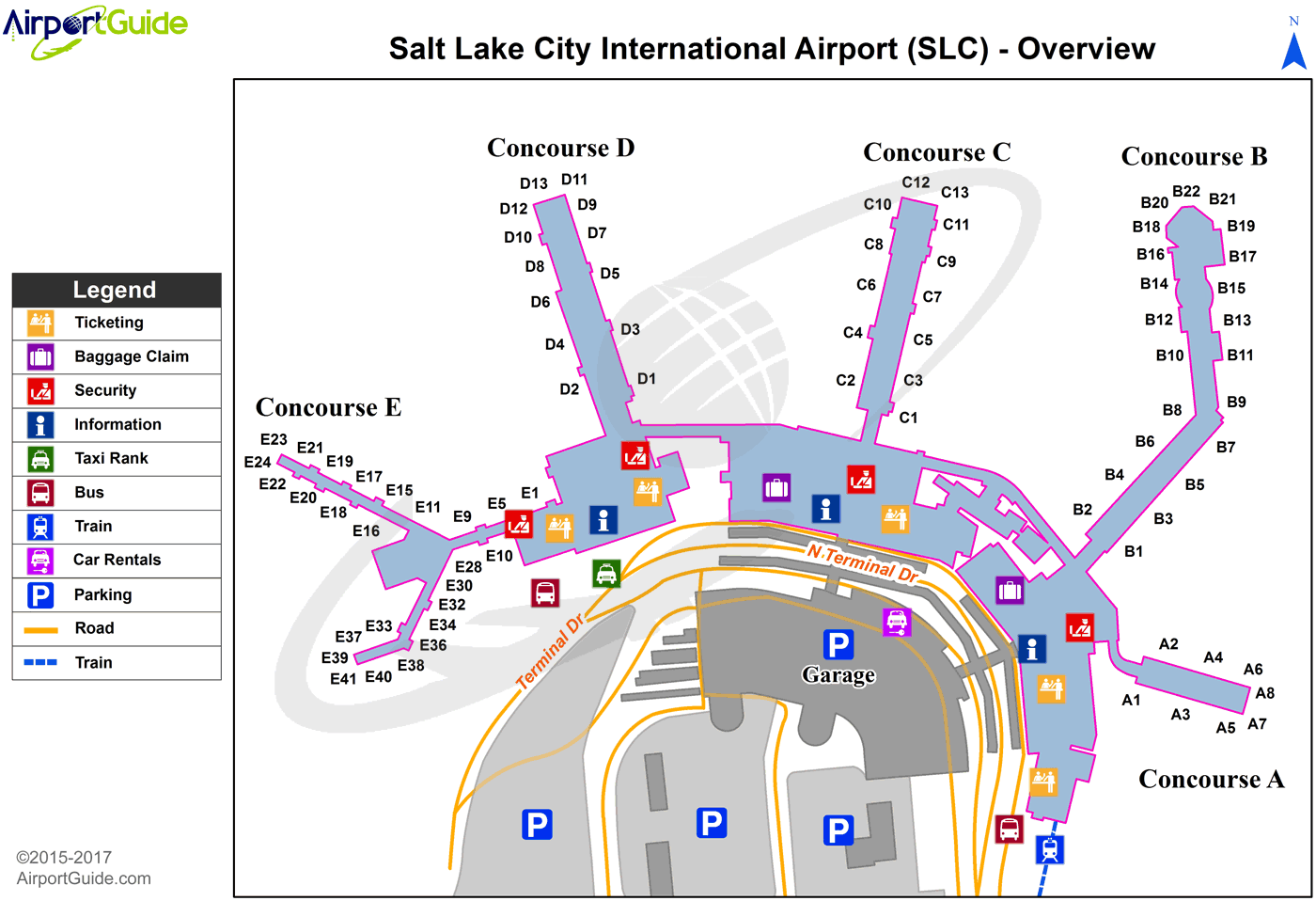

Domestic area

The particular location away from a house influences each other the home loan and refinancing costs. Specific neighborhoods is riskier than the others, and several metropolitan areas demand large home values, leading to variability during the mortgage wide variety and you can interest levels.

In thicker, metropolitan areas, condominiums and you can multi-equipment formations comprise a more substantial portion of overall city real home, but because Fannie mae cards, employing produce and you will area, these attributes try regarded as riskier expenditures.

This is why interest rates are usually 0.25 commission situations high relative to traditional single-household members house, which can be usual inside the outlying elements.

Type of refinance

Because borrowers exchange you to home loan which have a separate in an effort to minimize look at these guys its financial rates, they have different kinds of re-finance money to look at. The essential conventional mode, the speed-and-title, supplies a lower rate of interest, because do a vintage fixed-rate re-finance.

On the other side avoid of one’s spectrum, cash-aside and you will variable-price refinances can result in higher interest levels about close identity.

Loan-to-well worth

The amount due towards a home according to the new appraised well worth of these residence is the borrowed funds-to-well worth ratio. In the event that a debtor however owes $fifty,000 to your a great $200,000 family, the new LTV is actually twenty-five% (three-quarters of one’s mortgage is paid down, having one-one-fourth still to visit).

Lenders usually want individuals to acquire home loan insurance rates in the event that the LTV is higher than 80%, though after LTVs all the way down, borrowers might possibly re-finance to the a lesser-price financial. As more guarantee are achieved for the property, borrowers do have more power so you can discuss top home loan terms.

One of the better an effective way to exploit the factors mentioned significantly more than is actually for borrowers to means various loan providers to go over possible home loan possibilities one finest match their particular means.

This new core of the house to acquire and you will re-finance all the opportunity to possess spending less, if which is through a lower life expectancy interest otherwise through the waiving out-of specific fees.

As an example, most individuals should expect to pay even more surcharges for appraisals, origination, document preparation, programs, label insurance, and much more. not, loan providers are often versatile with our charges on how best to sign into dotted line. This is to point out that home loans are entirely flexible, hence degree is actually a strong unit.