Erika Rasure are all over the world-recognized as a respected consumer business economics subject matter specialist, specialist, and teacher. She is a financial counselor and you may transformational advisor, which have a separate interest in enabling feminine learn how to purchase.

Katrina Avila Munichiello is actually a talented editor, blogger, fact-examiner, and you may proofreader with more than fourteen years of sense coping with printing an internet-based guides.

What’s an initial Home loan?

An initial financial is an initial lien to your property. While the top loan that covers a property, it offers priority overall other liens otherwise claims toward a good property if there is default. An initial mortgage is not necessarily the mortgage on the an effective borrower’s basic family. Instead, it’s the brand-new home loan started property. It’s also named a primary lien. If the house is refinanced, then your refinanced financial assumes the original home loan reputation.

Key Takeaways

- An initial mortgage are an initial lien into the possessions one secures the borrowed funds.

- Next home loan are currency lent facing home guarantee to pay for other strategies and costs.

- Lenders generally wanted private financial insurance in the event the financing-to-well worth (LTV) ratio off a first home loan was more than 80%.

- The borrowed funds notice repaid towards the an initial mortgage are tax deductible, just applicable in order to taxpayers whom itemize expenditures to their tax statements.

Knowledge Basic Mortgages

Whenever a customers desires get a house, they might want to funds the acquisition having an interest rate out-of a loan company. This involves trying to get home financing for the lending company, bringing approval, and you will signing the data.

Whenever a primary mortgage was provided, the lender anticipates the house financing otherwise financial getting reduced when you look at the monthly premiums, which includes area of the principal and you may attract money. The lender takes out a great lien on assets as house secures the loan. Which mortgage applied for from the a good homebuyer to acquire our home is known as the original home loan.

The original financial ‘s the brand new financing taken out on the a great possessions. That isn’t the first home loan consumed in its name. The fresh new homebuyer have numerous features inside their label. But not, the original mortgages taken out in order to secure for every possessions happened to be the fresh first-mortgage. Instance getting a loan in Lone Tree, in the event that a property owner takes out home financing for each of the three house, after that each one of the about three mortgages ‘s the first-mortgage.

The borrowed funds appeal reduced towards the an initial financial is tax-deductible, definition property owners decrease its taxable money because of the quantity of desire paid off on financing to your income tax 12 months. However, the borrowed funds desire tax deduction is just applicable so you’re able to taxpayers who itemize expenditures on the tax statements.

First-mortgage Requirements

First mortgage requirements can differ centered on whether you’re choosing a old-fashioned loan or an authorities-recognized loan, such as a national Housing Administration (FHA), U.S. Service off Farming (USDA), otherwise U.S. Company off Veterans Situations (VA) loan.

- Minimal credit score must meet the requirements

- Down payment wide variety

- Settlement costs and just what portion of the brand new closure prices is going to be paid of the vendor

- Mortgage fees terms

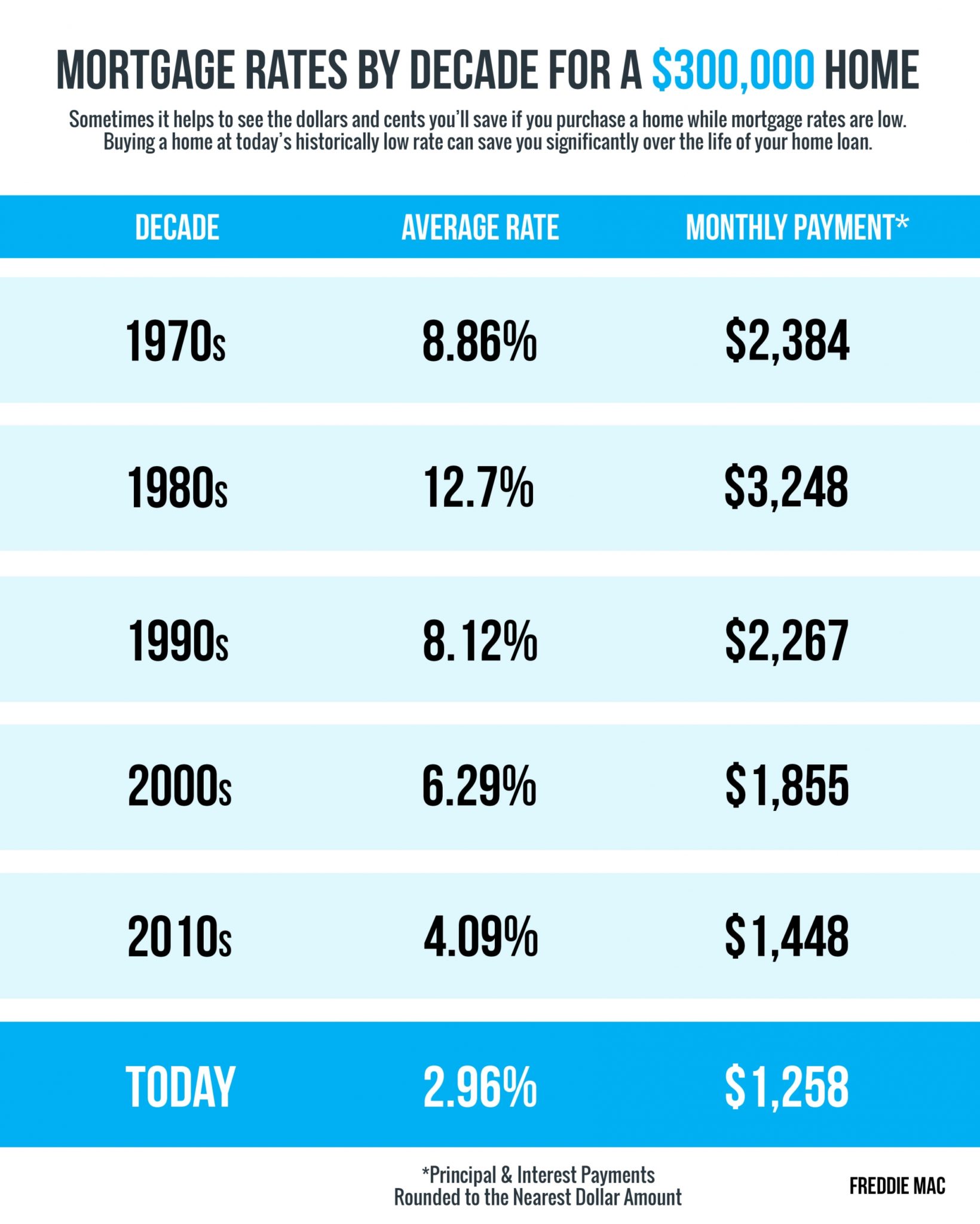

- Rates

The kind of possessions may also matter when bringing a first financial. FHA fund, such, allow you to buy a single- to help you five-product house or apartment with only step 3.5% down and you can a credit rating as low as 580. However,, the house or property alone need certainly to satisfy particular criteria to qualify for the latest loan.

Poor credit isnt necessarily an outright roadblock to getting an effective first mortgage, it could affect the loan conditions you be eligible for and you may the attention pricing you pay.